On July 1, 2021, 27 EU countries will implement new e-commerce sales value-added tax rules, which may affect your sales to EU consumers through the Amazon online store.

Starting July 1, 2021:

◆ If you are an FBA/overseas warehouse seller (the EU inventory is shipped to EU buyers)

1. For delivery to EU individual buyers (B2C orders), Amazon will withhold and pay value-added tax;

2. The threshold for remote sales within the EU will be uniformly adjusted to €10,000. but! Since the VAT is withheld and paid by Amazon, you do not apply this distance selling threshold. Therefore, after July 1, you only need to comply with the tax calculation principles of the destination country and perform tax calculations. There is no need to worry about the impact of the new distance sales threshold on tax calculations. At the same time, you need to register a VAT number in the EU countries where there are stocks.

3. In the same way, Union-OSS is not applicable to Amazon sellers registered in China.

◆ If you are an MFN seller (the inventory outside the EU is shipped directly to the EU buyer)

1. For delivery to EU individual buyers (B2C orders), if the value of a single order shipment is less than or equal to €150, Amazon will withhold the value-added tax on behalf of the company. At the same time, such shipments need to be accompanied by IOSS related information;

2. For orders delivered to France (other EU countries will not be affected), the sale of goods with a shipment value of more than €150 will be restricted, that is, your buyers will not be able to place orders for such goods after July 1. (Please note: If you use the EU stock (FBA/overseas warehouse) to ship to France, it will not be affected);

3. Orders from outside the EU (MFN) inventory delivered to EU buyers with a shipment value ≤ €22; currently no VAT is required, but the VAT exemption will be cancelled after July 1st. That is, all orders sold to the EU in the form of self-delivery are subject to VAT. And B2C orders with self-delivery ≤ €150 will be deducted and paid by Amazon.

In response to this change in Amazon withholding and paying EU VAT, Amazon sellers can take:

1. Remember to check and update your seller platform account details;

2. Don't forget to check your pricing and make sure that all the selected product prices on Amazon Europe Mall include VAT.

◆ At the same time you also need to pay attention to the European generation

EU product safety regulations will also come into effect on July 16, 2021.

Reminder:

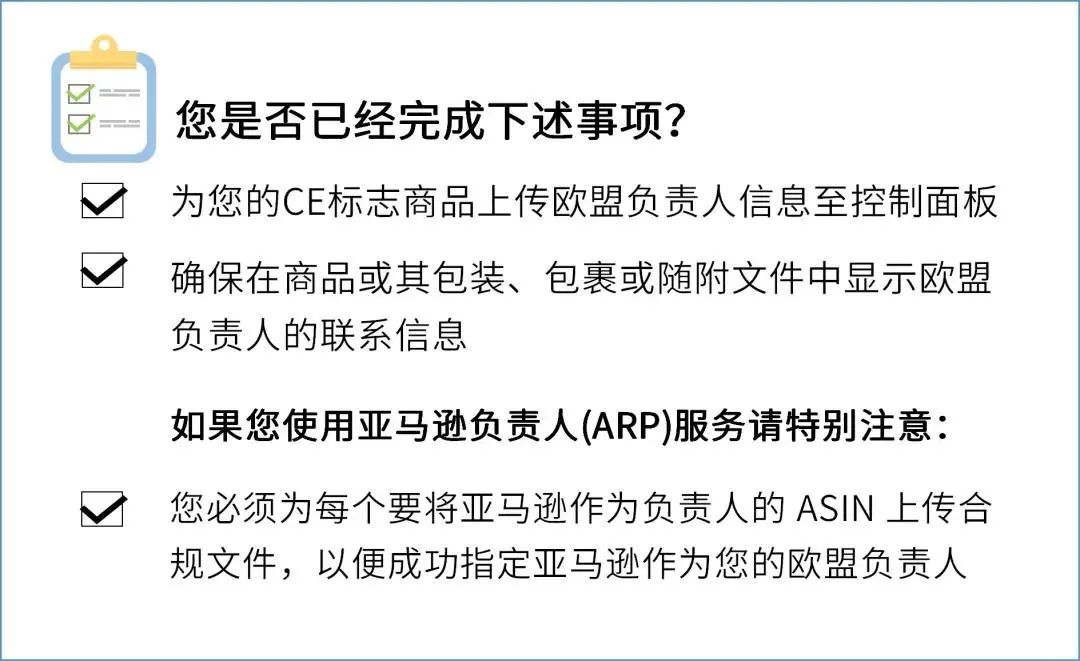

Starting from July 16, 2021, all commodities affected by this regulation need to have an EU person in charge when entering the EU, and customs and relevant regulatory agencies will conduct random inspections. Therefore, whether you are using Fulfillment by Amazon (FBA) or self-delivery (MFN) sellers, please display the contact information of the EU responsible person in the product or its packaging, package or accompanying documents for your CE marked products.